Gallery Viability Calculator

Calculate Your Gallery's Survival Chances

Based on industry data from 2023-2024, 60% of small galleries close within 5 years. This tool helps you assess if your business model has a viable chance of survival.

Results

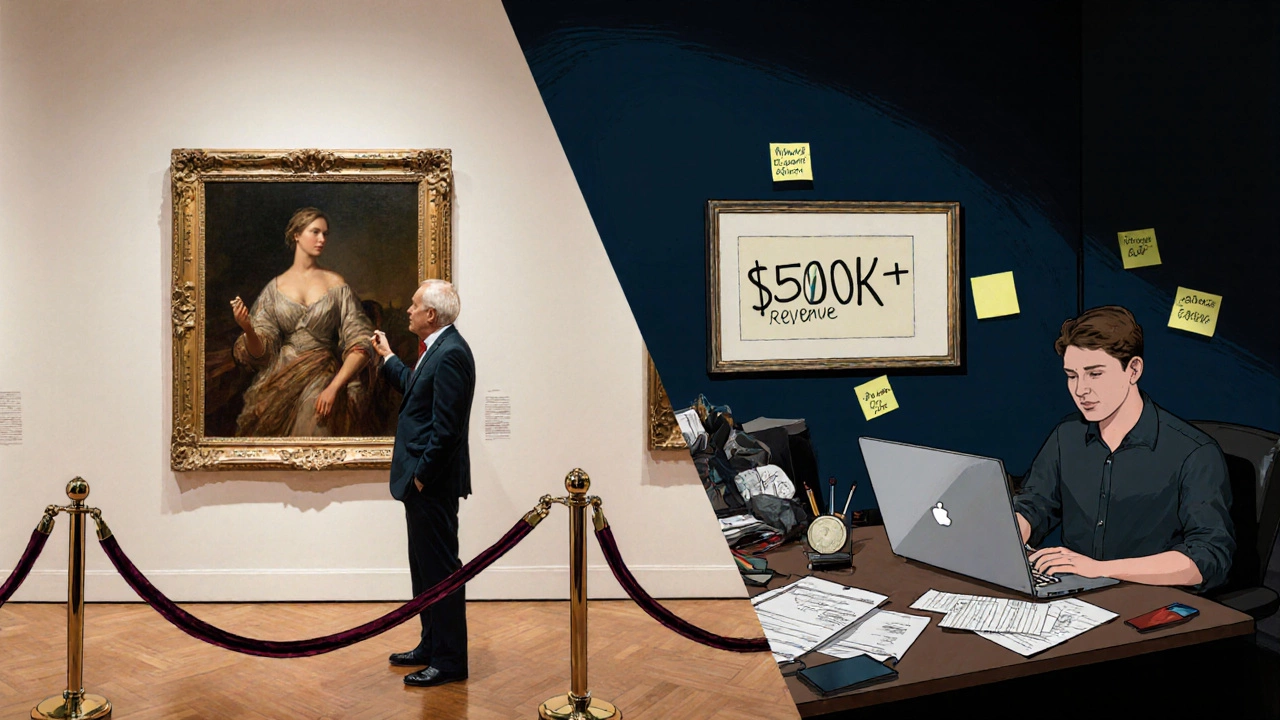

Most people think art galleries are glamorous spaces filled with elegant openings, wealthy collectors, and priceless masterpieces. But behind the velvet ropes and white walls, a quiet battle is being fought-many galleries don’t make it past their third year. The truth? The success rate of art galleries is lower than most people realize.

What Does ‘Success’ Even Mean for an Art Gallery?

Success isn’t just about selling a few paintings. It’s about staying open, paying rent, covering staff salaries, and making enough to reinvest in new artists. A gallery that sells one piece a month might look successful on Instagram, but if it’s losing $5,000 a month on overhead, it’s just delaying the inevitable.

According to a 2023 survey by the Art Dealers Association of America, nearly 60% of small independent galleries in the U.S. closed within five years. In Europe, the numbers are similar. London’s South Bank alone lost 37 galleries between 2018 and 2023. In New Zealand, where the art market is smaller and less saturated, the survival rate is slightly better-but still fragile.

Success means more than visibility. It means financial stability. It means artists get paid on time. It means the gallery can afford to take risks on unknown talent without going broke.

Why Do So Many Galleries Fail?

There’s no single reason. It’s a mix of bad timing, poor planning, and unrealistic expectations.

- Rent is killing them. Prime gallery districts in cities like New York, London, or Sydney charge $80-$150 per square foot annually. A 1,200-square-foot space can cost $100,000+ per year just in rent. That’s before lighting, insurance, or staff.

- Artists aren’t customers-they’re partners. Many gallery owners expect artists to bring collectors. But most emerging artists don’t have a following. The gallery ends up doing all the marketing, often for free.

- Collectors are fickle. The top 5% of collectors buy 80% of the art. The rest of the market is made up of casual buyers who attend openings but rarely buy. Galleries that rely on foot traffic from events often end up with empty walls.

- Online competition is growing. Platforms like Artsy, Saatchi Art, and even Instagram let artists sell directly. Buyers don’t need a gallery to discover art anymore. That’s forced galleries to become more than just showrooms-they have to be marketers, curators, and community builders.

One gallery owner in Wellington told me, “We used to host two openings a month. Now we do one. The rest of the time, we’re answering emails, updating websites, and chasing payments from collectors who say they’ll pay ‘next quarter.’”

Who Actually Makes It?

Not all galleries fail. The ones that survive share common traits.

- They have a niche. A gallery focused on Māori contemporary art in New Zealand, or a space dedicated to digital installations in Berlin, stands out. Generic “contemporary art” galleries drown in noise.

- They build long-term artist relationships. The best galleries don’t just represent artists-they invest in them. They help with studio grants, fund residencies, and get their artists into biennales. That builds trust and repeat sales.

- They diversify income. Successful galleries don’t rely on sales alone. They offer art consulting, limited-edition prints, workshops, and even rental services for corporate spaces. One gallery in Auckland makes 40% of its income from corporate art leasing.

- They’re lean. Many surviving galleries operate with just one or two full-time staff. The owner often doubles as the curator, accountant, and social media manager. No luxury. No frills. Just survival.

A 2024 report from the Australian Council for the Arts found that galleries with annual revenues under $200,000 had a 78% failure rate. But those making over $500,000 had a 72% survival rate over five years. The difference? Scale, strategy, and sustainability-not fame.

How Do You Measure Success?

Let’s break it down with real numbers:

| Metric | Low-Performing Gallery | Successful Gallery |

|---|---|---|

| Annual Revenue | Under $150,000 | $500,000+ |

| Artworks Sold Per Year | 10-20 | 60-100+ |

| Artist Retention Rate | Under 40% | Over 80% |

| Operating Margin | Negative | 15-25% |

| Primary Income Source | Art sales only | Art sales + consulting + editions + events |

Notice something? The successful galleries aren’t necessarily selling the most expensive art. They’re selling more art, consistently. And they’re not waiting for collectors to come to them-they’re creating the demand.

The Hidden Truth: Most Galleries Are Not Profitable

Here’s a hard fact: even many “successful” galleries don’t make a profit for their owners. They’re passion projects. One gallery owner in Berlin told me, “I make $35,000 a year running my gallery. I could make $90,000 as a graphic designer. But I’d rather be here.”

That’s the reality. Many gallery owners subsidize their spaces with savings, side jobs, or family support. The art world romanticizes the idea of the visionary dealer. But behind that image is often debt, sleepless nights, and a second job just to keep the lights on.

That doesn’t mean it’s not worth it. For some, the cultural impact matters more than the profit. But if you’re thinking of opening a gallery, you need to know: you’re not starting a business. You’re starting a long-term commitment-with financial risk.

What’s Changing in the Art Market?

The old model is collapsing. Galleries that still operate like they did in the 1990s are vanishing.

Today’s winners are:

- Hybrid spaces. A gallery in Melbourne combines a small exhibition area with a coffee shop and artist residency program. It’s not just selling art-it’s building a community.

- Regional galleries. Outside major cities, rent is cheaper, and local audiences are loyal. A gallery in Nelson, New Zealand, with 300 square feet and no staff, makes $300,000 a year by focusing on regional artists and selling online.

- Cooperative galleries. Artists pool resources, share rent, and rotate curation duties. No owner. No hierarchy. Just shared risk and reward.

The future belongs to galleries that stop pretending to be luxury boutiques and start acting like community hubs.

Final Thoughts: Is It Worth It?

The success rate of art galleries is low-but not because the art isn’t valuable. It’s because the system is broken. The cost of entry is too high, the buyers are too few, and the competition is too fierce.

But if you’re willing to rethink everything-how you make money, who you serve, and how you operate-you can still build something lasting. The galleries that survive aren’t the ones with the fanciest walls. They’re the ones that adapt, serve their communities, and refuse to treat art like a luxury commodity.

Art doesn’t need a gallery to matter. But galleries still matter to artists who need space, support, and a way to be seen. The question isn’t whether galleries will survive. It’s whether they’ll evolve-or disappear.

What percentage of art galleries make a profit?

Only about 20-30% of independent art galleries consistently make a profit after covering all costs. Most operate at a loss for years, relying on owner subsidies, part-time jobs, or outside funding. Profitability depends heavily on revenue scale-galleries making under $200,000 annually rarely break even.

How long do most art galleries last?

Half of all independent galleries close within five years. The average lifespan is between four and six years. Those that survive past seven years usually have a clear niche, diversified income, and low overhead. In cities like Wellington or Nelson, survival rates are slightly higher due to lower costs and strong local support.

Do galleries make more money from sales or events?

Sales are the main source of income, but events rarely turn a profit. Opening nights cost thousands to host and rarely lead to direct sales. Successful galleries use events to build relationships, not income. The real money comes from repeat buyers, art consulting, limited editions, and corporate partnerships-often generated over months or years, not during a single night.

Can online galleries replace physical ones?

Online platforms are taking market share, especially for emerging artists and lower-priced work. But physical galleries still dominate high-value sales and collector relationships. Buyers of $10,000+ artworks often want to see the piece in person, feel the texture, and meet the gallery owner. Physical spaces add trust and context that screens can’t replicate.

What’s the biggest mistake new gallery owners make?

They assume art will sell itself. They spend money on prime locations and fancy lighting but skip marketing, financial planning, and artist support. The biggest failure isn’t bad taste-it’s poor business sense. Running a gallery requires equal parts art knowledge and accounting skills.